- Posted on : May 31, 2017

-

- Industry : Insurance

- Type: News

GirishKannalli, VP & GM-Insurance and Healthcare Business Unit, Infogain

The trend of digitisation and machine learning is making the highly regulated insurance sector more automated. The traditionally alert insurance industry has been resistant to embracing automated technologies for a long time; however, to keep pace with the emerging trends and growing expectations of the next generation of consumers, the insurance industry is gearing up to adopt the latest artificial intelligence (AI)tools and analytics.A study recently conducted by research firm Technavio revealed that over the next four years, insurance technology is likely to grow steadily with a compound annual growth rate of over 10 percent by the year 2020.

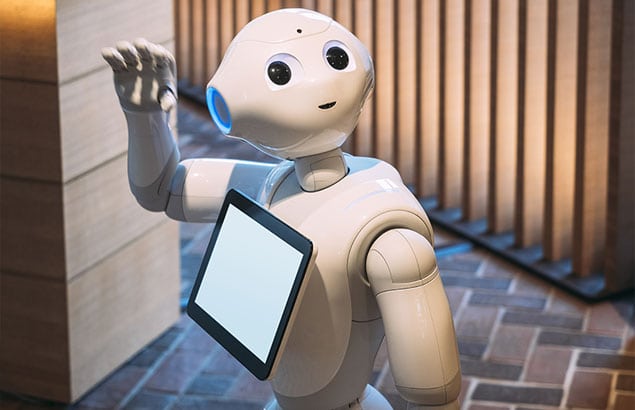

Insurance companies are increasingly adopting AI technology for operational excellence,easier renewals, fraud controls,faster claims settlement,improving service turnaround times, wellness features, reducing operational costs, and driving successful client acquisition. At the present times, automated investment platforms or automated agents, also known astech advisors or robo-advisors powered by AI technology are making a mark in the insurance industry by revolutionising customer interaction.A robo-insurance advisor is a software program designed for executing tasks that were previously delivered by human insurance agents. These automated platforms provide policyholders with automated algorithm-based insurance advice, with minimum human intervention.

Insurance Companies Applying Robotics

Let’s take the example of the NYC-based peer-to-peer insurance firm Lemonade launched in 2016. Lemonade uses artificial intelligence for quickly screening applicants and claims as its automated software can accumulate relevant data about a particular neighbourhood or home from multiple sources in seconds; thus eliminating the need for the insurance firm to gather information directly from the customers.Lemonade offers delightful customer experience by making use of machine learning and bots for replacing human agents and paperwork. These bots can perform simple tasks automatically besides facilitating insurance service through Lemonade’s mobile app.

Robo-insurance advisorsnot only offer objective advice but also put forward unprejudiced comparison of advanced insurance products by taking into account several variables over and above price. These automated tools utilise automated algorithm to process a huge volume of data for envisaging the future requirements in the blink of an eye. This enables insurance customers to understand which insurance solution can cater to their needs seamlessly.What’s more, robo-advisors also play a key role in fortifying the omni-channel strategy integrating different platforms of interaction.

Automated agents or robo-insurance advisors can streamline the insurance industry performing the following functions

Accumulating essential data about clients and their insurance policies, and storing the relevant information securely.

Offering professional advice about insurance policies to make sure that the policyholders have an optimized insurance portfolio that is best suited to their requirements and budget.

Assisting the clients to renew or terminate their insurance policies if they are unbefitting.

Managing the policies of clients to alert the insured party when their policy needs to be renewed.

Reducing human error, human bias, and overall portfolio risk.

Automated agents are beneficial to both insurance companies which make them available to others as well as the policyholders who use them.

The insurance sector is steadily embracing artificial intelligence with open arms for delivering unparalleled service

Robo-Advisors Benefit Insurance Companies

Insurance agencies can make their services available to a huge number of existing and prospective customers.

They can offer their service to an indefinite number of people concurrently, thus saving time and money.

The services and advice offered are totally consistent.

Insurance agencies can avail the digital footprint of the advice offered to people; and

They can help customers and prospects with their expertise and knowledge 24×7 throughout the year.

Robo-Advisors Benefit Policyholders and Prospects

Customers can get the best professional advice as and when required.

Customers can take as much time they want to get professional advice.

Since automated-advisors are based on complex algorithms, they can curate the best insurance policy based on the financial risk tolerance of individual customers.

Maximize customer experience by leveraging Neuro-linguistic Programming and speech recognition.

Considering the above-mentioned factors, the insurance sector is steadily embracing artificial intelligence with open arms for delivering unparalleled service. With the exponential rise of AI technology across all sectors, it becomes crucial for insurance companies to follow the industry trend so that they do not end up becoming obsolete. By leveraging AI capabilities, insurance companies can prepare themselves to face market challenges in a smart manner than their competitors. What’s more, they can also identify indiscernible changes taking place in the market, besides developing a real-time appreciation of the demographic and behavioural actions of prospective customers.

The Challenges Ahead

However, there are some challenges that the insurance sectors will need to overcome in order to implement sophisticated robotics with confidence. For example, the implementation of bots by insurance companies raises the issue of governance. As the bots are interdependent on the outputsof each other, it makes one wonder how will they function together to estimate the business metrics. This may also raise doubts about their algorithms, calculations, and methodologies.

More over, since machine learning depends on building a storehouse of consistent data, it becomes important to ensure that the bots are utilising the right data so as to utilise the value of cognitive robotics safely. At the same time, insurance CEOs should identify the best combination of humans and bots that customers will accept and how humans and bots should interact to guarantee maximum value. Though robo-advisors do not have the ability to offer personally customized services that a human insurance advisor can deliver(Yet),they form an integral part of the insurance industry as robo-advisors can go a long way in reinforcing the operational efficiency of insurance companies.

News Originally Posted on: Silicon India Magazine